Buddy Loan is the Digital Fintech Marketplace facilitating loan services for all eligible age groups. We make way for quick loan approvals and are recognised with one of the highest approval rates in the industry!

We work with a vision to break financial barriers and to make loans easily accessible to all. Our instant loan app provides borrowers easy access to loans for their financial needs from our enlisted RBI-approved lenders.

Our services reach beyond continents and deliver unique financial solutions.

"Facilitate swift and hassle-free loan approvals, empowering individuals and businesses to achieve their financial goals; one approval at a time”

Our commitment to financial inclusion and customer-centric service drives us to provide unique loan services that help people achieve their dreams and aspirations

Buddy Loan is a Digital Fintech Marketplace. Our range of loan services caters to various financial purposes, such as medical expenses, education, travel, debt consolidation, or any other financial needs.

Disclaimer: To get the most accurate and up-to-date information on the loan services offered by Buddy Loan, stay tuned!

Now more than ever, it is easier to get a personal loan from an approved list of RBI-approved lenders. We have helped bridge the gap between many lenders and borrowers with quick approval rates and completely transparent unsecured loan journeys.

| In the market since 2019 |

2 million Daily Active Users |

17 M+ Daily Applications & Growing |

1 billion soft loan approvals to date |

80%Approval rate |

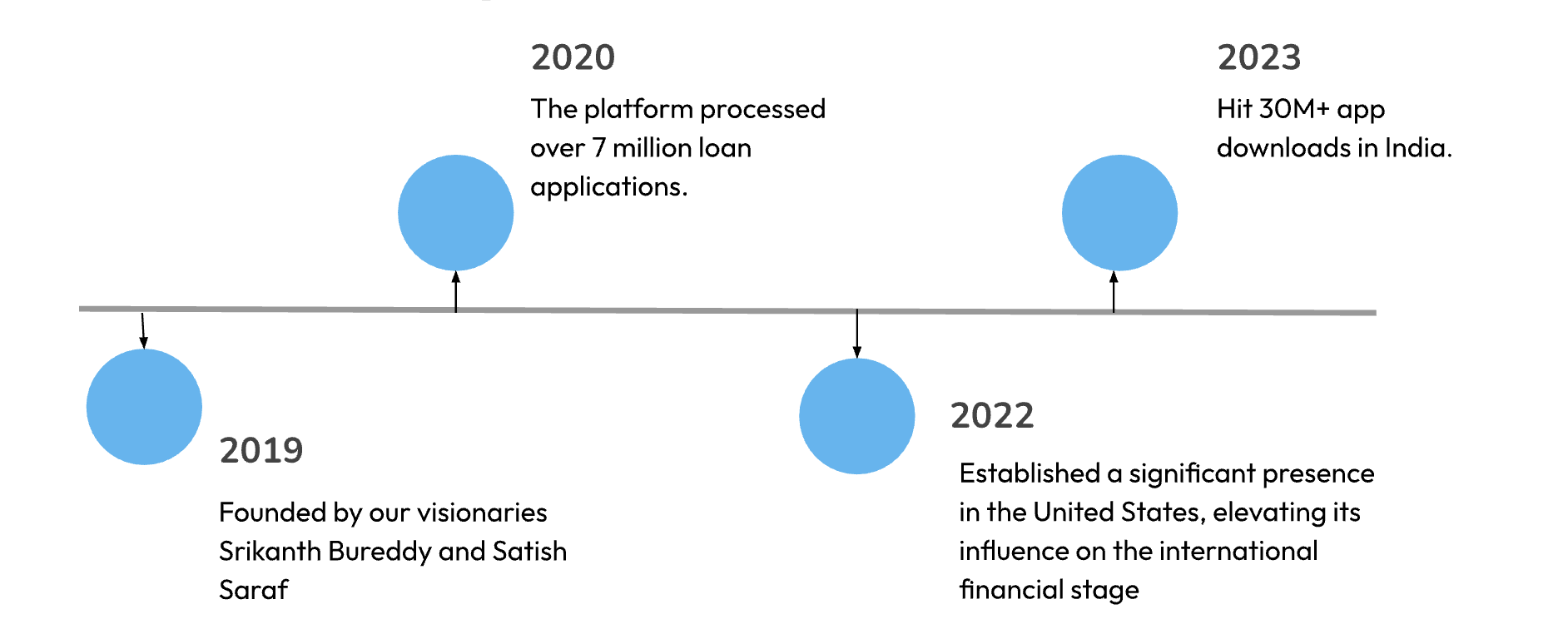

2019 - Our simplified financial solution took shape as the customer ally and became the fastest-growing Digital Fintech Marketplace.

2020 - The exponential growth outperformed the industry yardstick and redefined numbers with the platform's efficiency—the substantial demand for innovative loan solutions shot up this particular year.

2022 - Buddy Loan's global expansion ensured a significant presence in the United States. Our solutions made a unique comeback in the loan marketplace & Digital Fintech Marketplace.

2023 - Buddy Loan made soft loan approval the norm by surpassing 30M+ app downloads in India.

Business loans in India help fuel growth, offer flexibility, and aid cash flow management for businesses. Timely repayments enhance credit history and future financing options.

Access up to ₹15 Lakh in

a flash to meet your

financial needs

Enjoy the benefit of

pocket-friendly interest rates,

starting at just 11.99% p.a.

Our streamlined processes

ensure rapid approval & is

industry's top approval rate

Plans designed to align

seamlessly with your financial

capabilities.

Your financial data Is

treated with the utmost

confidentialty

Testimonials from satisfied customers: video-testimonials

For assistance or more information about personal loans and to address concerns, please contact us at info@buddyloan.com.

You Can Connect over :

At Buddy Loan, an applicant can apply for a minimum loan amount that is Rs. 10,000 and the maximum loan amount is Rs. 15 Lakhs at lower interest rates starting from 11.99% p.a. The Applicant can repay the same over a flexible tenure ranging from 12 months to years.

When you are in urgent need of cash, there are very few options available. Traditional banks take a long time to approve and process loan applications. But if you are looking for an instant loan with fast approval, user-friendly interface, and quick sanction, then Buddy Loan is the answer. Buddy Loan - One of the fastest-growing Digital Fintech Marketplace that connects the borrowers with RBI-approved lenders on its platform, well-known for the highest approval rate in the industry and quick processing.

Buddy Loan is the best app for personal loan. It is one of the fastest-growing Digital Fintech Marketplace that connects the borrowers with the RBI-approved lenders on its platform, well-know for the highest approval rate in the industry and quick processing. If you are lookin for an instant loan with fast approval, user-friendly interface, and quick sanction then Buddy Loan is the answer.

If you are looking for a safe and secure instant personal loan app then Buddy Loan is the right place. Buddy Loan is one of the most trustworthy apps where the entire process is transparent. Buddy Loan has created a safety net for its customers by partnering with RBI-approved lenders. Hence, the app is completely safe to use.

Though there are multiple banks and NBFCs that offer personal loans to meet all financial needs. But if you are looking for a quick and instant loan online, then Buddy Loan is the right place. You can get a quick access of personal loan up to Rs. 15 Lakhs through an easy digital process. You need to download the app, fill in the required details, submit the documents, choose the lender, and wait for a few minutes to get the approval. Once approved, your loan amount will be credited directly to your bank account within hours.

Applying for a personal loan online is easy and simple with Buddy Loan. If you are planning to take a loan, then follow the below steps

It's always suggested that you check the eligibility criteria and other factors before the final submission.

Though Buddy Loan sets a simple eligibility criteria and digital documentation process to avail a personal loan. However, the minimum salary required to get a quick loan is Rs. 18,000.

Buddy Loan is a user-friendly digital-only platform, accessible 24/7 through web and android app. Using the app, you can apply for a loan upto 15 lakhs instantly. The users can also avail exciting deals & offers, earn & redeem points at multiple levels.